Venture2 has promoted the value of rapid iterations and in-market experimentation long before Lean Startup became a popular trend. We have a long track record of working with both entrepreneurs and large companies helping clients adapt the principles of lean and incorporate them within their innovation and new business creation efforts. Unfortunately too many companies are attempting to apply lean startup principles wholesale, which simply won’t work. Why? Startups and large companies are different animals.

Startups are by definition risk-takers. They have a natural entrepreneurial spirit and willingness to pivot in entirely new directions based upon market feedback. Their horizons for success within the VC model don’t permit the luxury of time. On the flip side, large companies are by their nature risk averse. Their cultures, reward systems and processes are based on optimizing brands, products and delivery for business success at scale. Companies at scale simply can’t afford unnecessary risk-taking.

Despite these differences, I wrote in a recent post, “Can Lean Startup Principles Work for Corporates,” that yes they can, and they are. Here are some specific recommendations on adapting lean concepts from the startup world to more transformative efforts within large companies.

Customer Development

For Startups – This is a key area where lean thinking aims to eliminate waste in the startup process. Customer development is about “getting out of the building” to engage with customers directly and upfront, validating who customers are and what their problems are before undertaking significant product development.

For Corporates – Formal, sophisticated consumer and market research has its place, but for new breakthrough initiatives with high unknowns, put away the spreadsheets and get your teams outside of the building to engage directly with customers. There’s great power in getting product or service development teams directly involved in upfront customer engagement. Simple contextual interviews in your customers’ environment will invariably surface new insights that are then more deeply understood by development teams because they’ve heard them in the customers’ own words. And simply searching for the right customers who fit your targeted profile is an early indicator for how hard it might be to find and reach these customers when you have a product or service to sell.

Example: When I was involved in supporting the development of a nanotechnology flow sensor with a client, the initial inclination was to develop a working prototype and pitch it to potential industrial companies in the market that my client assumed would be interested. Instead, we conducted interviews with executives in several different industries, from medical to industrial waste treatment. We did not focus on our solution but probed for which companies and industries were frustrated by the cost, inaccuracies, and size of current flow measurement technologies. These interviews drove a complete shift from an assumed focus on industrial flow sensors to more lucrative and white-space opportunities for flow sensing in IV drips.

Validated Learning

For Startups – Entrepreneurs develop new systems and products through a rigorous process of creating hypotheses and then testing these assumptions quickly to iterate toward a successful solution faster and at less expense. This build-measure-learn cycle repeats itself throughout development.

For Corporates – This may be the easiest lean startup concept to translate from small company to big company. This is a discipline quite easily understood and adaptable to corporate venturing teams. Big companies love data. They hardly make a move without some sort of data. When I go into a big frm to talk about applying a validated learning experience, we help company leaders apply a phased approach to their programs with learning objectives at each stage. Lean startups’ process of learning and applying that learning in an ongoing way is injected into existing big-company appreciation for numbers. The difference here is that we’re measuring to learn and adjust, not just measuring against end goals.

Example: GlaxoSmithKline (GSK) used a series of defined experiments with limited funding to validate a breakthrough opportunity that entailed a new business model and disruptive solution for the consumer dentures market. According to Stan Lech, former VP of innovation, the team’s ability to build-test-learn during definition of the project was a key factor in their speed and effectiveness.

Minimum Viable Product (MVP)

For Startups – Closely related to the concept of validated learning is building early versions of the product from the perspective of the absolute minimum needed versus the often traditional approach of providing many bells and whistles in the name of delivering additional value for the user/consumer.

For Corporates – If you’re developing a new drug or packaged good, the idea of the MVP does not hold in a literal sense. We need to recognize that launching a software product that can be rapidly prototyped is a long way from a new drug being developed by a pharma company or a durable appliance that requires long-lead tooling. Instead, corporate teams need to create elements of the business proposition that can be developed and tested, usually in market. In the corporate context, MVPs need to be good enough to validate that your customers see the value and are willing to look past the initial flaws.

Example: Before the wonderful Tesla Model S was off the drawing boards, Elon Musk and the Tesla team developed and launched an MVP called the Roadster, which was, in essence, a Lotus Elise that was retrofitted with early-generation lithium ion battery packs. While still an expensive development effort, it provided invaluable performance and market feedback at a small fraction of the cost of a ground-up vehicle development program.

Pivot or Persevere

For Startups – The build-measure-learn loop helps startups quickly get close to real customers and gain real-time feedback on needs. When done correctly, it will be clear whether the company is moving the drivers of the business model. It then faces the decision to pivot (change the business or business model to match the market) or persevere (on the assumption that the core hypothesis for the business is still true).

For Corporates – Many corporate teams and their leaders refuse to acknowledge failure. It’s understandable why they do this. In most companies, the reward system is designed in such a way that admitting failure costs money, while denying failure can work to your financial advantage. Although that may be a decent individual strategy, it does not help a big firm learn to innovate. Corporate teams need to redefine success as learning faster, failing early, and minimizing or delaying investment. By applying elements of venture capital funding to corporate ventures, teams can also begin to adopt more agile mindsets. The ability to pivot depends on the corporate VC board’s being open to entirely new directions that might be out of the scope of the original charter. Traditional corporate life doesn’t prepare you for this process. Lean demands it.

Examples: IBM was a computer company for most of its history, first with mainframes and then with servers and PCs. But as the world changed and its business stagnated, the company pivoted into a global services organization that’s been growing ever since. In a different example from P&G, when it developed Nyquil as a cold/flu remedy, initial testing showed that the formulation caused users to feel sleepy. So instead of reformulating, it repositioned Nyquil as the first nighttime cold/flu remedy to help you sleep—and the rest is history.

Innovation Accounting

For Startups – Risky new ventures require discipline, unlike the “seat-of-the-pants” stereotype promoted about entrepreneurs. Successful entrepreneurs live and breathe metrics; they set goals and growth objectives that are measured frequently and used to adjust direction with agility. Because of these differences in process, the accounting for new ventures must be managed differently. Discovery-driven planning focuses not on accounting in terms of only final output but on measuring what has been learned to support agility.

For Corporates – Discovery-driven planning is antithetical to many corporate financial and management teams. It sounds like a bunch of words that can’t possibly go together, but it’s critical, given that we are measuring an unknown. To follow the lean startup process, there has to be room for discovery along the way. Teams must develop and gain senior team buy-in for milestone-based “learning metrics.” This allows for the discovery process to take place while still providing management with confidence that ventures are moving toward viability and success.

Example: At both Intuit and LexisNexis, leaders are encouraging the organization to focus on learning metrics and not traditional ROI measures for transformative or white space opportunities. “Love metrics” such as net promoter scores provide a simple mechanism for assessing whether the consumer propositions being tested are resonating with consumers and trending in the right direction. The net promoter score (developed by Satmetrix) is a simple 0–10 scale, and only promoters (9–10) are considered successful, as they’ll be loyal enthusiasts who will keep buying and actively refer others.

When Lean Doesn’t Fit

A lean startup process, while beneficial to a company, is not appropriate in all corporate settings. This is where big companies often lose their way. Convinced that lean tactics are the answer, executives seek to apply them wholesale from the books. People attend a lean startup workshop and then become a hammer looking for a nail. In contrast, when we promote these concepts for corporate clients, we include advice as to when and where they work best.

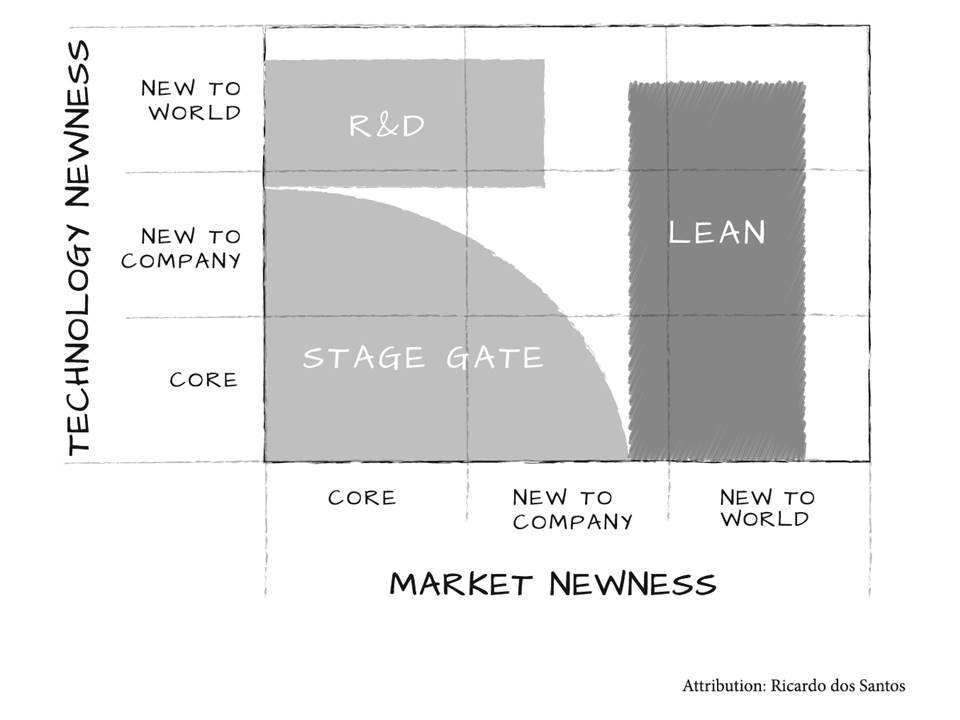

Ricardo dos Santos, understands lean in the corporate environment. He is a big proponent of lean methods (like me, he came from the auto industry), and his model (which he shared with me for my book) provides a simple way to think about where lean startup fits and doesn’t fit within corporate innovation.

For core technologies and core markets, stage-gate and traditional product development approaches have been proven and optimized to help companies develop new products and services efficiently. When we start to explore further-out technologies and solutions, that’s where advanced R&D efforts come in.

A startup is, in many ways, a search for a business model. So, in a corporate setting, when ventures include business model innovation, lean methods really start to come into their own. The iterative experimentation models can help us quickly build, test, and learn as we explore these opportunities in an environment of high unknowns and attempt to find that winning business model.

How has your larger company applied lean startup principles? When did you find success with these principles and when did they fail…and why? I would love to see your thoughts in the comments.